From Here to Close in Real Estate with Kristen Richardson

Saturday, March 1, 2014

Monday, January 20, 2014

What can staging do for your house?

The general rule of thumb in house sales is Master bedrooms and Kitchens often sell homes. However, if a home feels current, it also helps sell the home. Staging can make a home feel current and really enhance the Master and the rest of the house.

Staging can be as simple as changing out nick-nacks and pictures and re-arranging furniture or it can go as far as repainting to neutralize colors and changing out furniture. Have your doubts? Take a look at these before and after shots:

Staging can be as simple as changing out nick-nacks and pictures and re-arranging furniture or it can go as far as repainting to neutralize colors and changing out furniture. Have your doubts? Take a look at these before and after shots:

|

| Master Bedroom Before and after |

|

| Dining Room Before and after |

|

| Family Room Before and after |

|

| Bonus Room before and after |

|

| Sitting/Bonus Area Before and after |

|

| Living Room Before and after |

Saturday, June 1, 2013

Home Warranties - What are they?

As posted on http://www.crackerjackagent.com/blogs/1559/1367/put-your-mind-at-ease-with-a-hom

One of the scary things about making the leap from property renter to property owner is the idea of maintenance and upkeep. You’re no mechanic or repairman. You don’t know a socket wrench from a sheep ranch. And calling repairmen—how do you know you’re not going to get ripped off because of your lack of knowledge? One solution is the home warranty. These are often offered as part of the buyer’s incentive package when you are buying a home. Or you can purchase one directly.

Added Notes from Kristen:

General coverage:

One of the scary things about making the leap from property renter to property owner is the idea of maintenance and upkeep. You’re no mechanic or repairman. You don’t know a socket wrench from a sheep ranch. And calling repairmen—how do you know you’re not going to get ripped off because of your lack of knowledge? One solution is the home warranty. These are often offered as part of the buyer’s incentive package when you are buying a home. Or you can purchase one directly.

What a home warranty is not: It’s not a blanket insurance policy against anything ever going wrong in your home. It’s not a permanent warranty. It does have exclusions. Before you purchase or accept a warranty, it’s good to know what the warranty is, what it covers, what it doesn’t and how it works.

How does it work? Most home warranties are very similar, but not the same. You’ll want to read each warranty thoroughly and mark anything you don’t understand to have explained to you. But in general:

- If a home system or appliance breaks down or stops working, you call the home warranty company.

- You will pay a small service call fee (usually less than $100).

- Your home warranty company will call a service provider it has a business arrangement with.

- The service provider will call you to make an appointment.

- The service provider will fix the problem. If an appliance or system is malfunctioning and can’t be repaired, depending on your contract coverage, your home warranty company will pay to replace and install the appliance.

What if the service provider doesn’t fix something to your satisfaction or says that the problem is your fault and isn’t covered by your warranty? If the issue arises during the sales transaction, call your real estate agent. Your real estate agent might be able to assist in seeking a resolution for you.

What’s not covered? Check each specific policy, but in general:

- Outdoor items such as sprinklers

- Faucets

- Spas and pools, unless specific coverage requested

- Permit fees

- Haul away

What can cause denial of a claim?

- Improper maintenance

- Code violations

- Unusual wear and tear

- Improper installation

Added Notes from Kristen:

General coverage:

Here is an example of Old Republics Warranty Coverage - note there are several levels of coverage. Also note that coverage as a seller is different than coverage as a buyer.

To assist you in learning the differences among warranties and how they are administered, here are links to four different national warranty companies.

Old Republic Home Protection

2-10 Home Buyers Warranty

Cross Country Home Services

First American Homebuyers Protection

Here is a site that compares and reviews various warranties and the companies - Home Warranty Reviews.

Bottom line, home warranties can be invaluable, but you have to do a little research to find which one suits you and your situation.

To assist you in learning the differences among warranties and how they are administered, here are links to four different national warranty companies.

Old Republic Home Protection

2-10 Home Buyers Warranty

Cross Country Home Services

First American Homebuyers Protection

Here is a site that compares and reviews various warranties and the companies - Home Warranty Reviews.

Bottom line, home warranties can be invaluable, but you have to do a little research to find which one suits you and your situation.

Friday, May 3, 2013

Retirement at Its Best

Considering Tennessee for Retirment? - GREAT choice!

- Tennessee has

NO state income tax

NO gift tax

NO estate tax after 2016

Federal Income Tax deduction for TN Sales tax paid

See Forbes article for details on estate and gift tax repeals.

1. Location

2. Climate

3. Cost of Living

4. Health Care

5. Taxes

6. Recreation

7. Higher Education

8. Transportation

9. Cultural Offerings

10. Personal Preference

In her article Emily offers several websites one can search to get detailed information about these categories. See her article, Retirement at Its Best.

Thursday, April 11, 2013

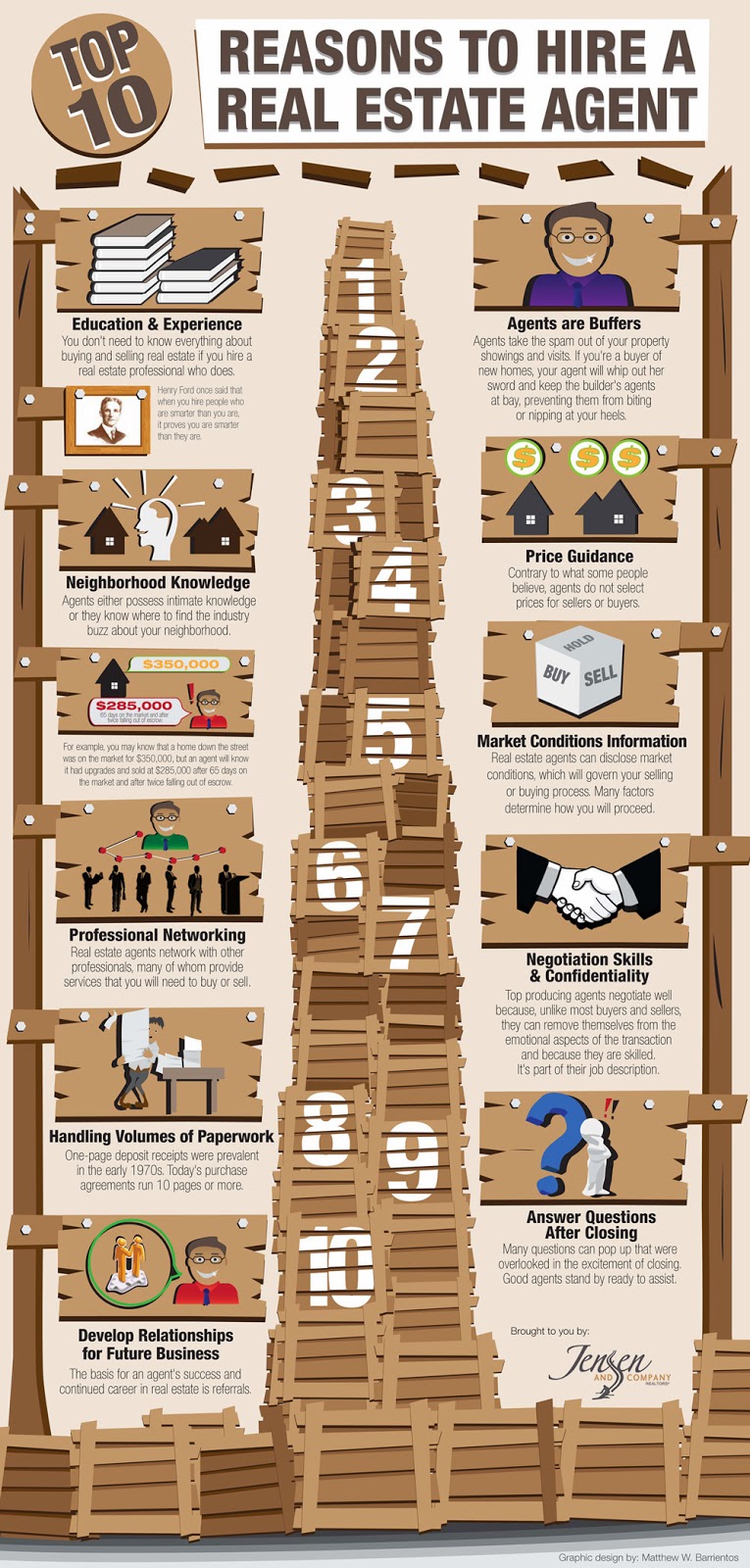

What Do Selling Agents Do?

Ever wonder

exactly what duties an agent completes to sell your home? Do you wonder why we suggest you need an

agent? Do you consider, should I sell my

house myself?

Pre-Listing

Activities

1.

Research

sales activity from MLS and public records databases for comparable properties

2.

Research

"Average Days on Market" for this property of this type

3.

Research

property tax information

4.

Prepare

"Comparable Market Analysis" (CMA) to establish fair market value

5.

Confirm

schools zones

Listing

Appointment Presentation

6.

Provide

overview of current market conditions and projections

7.

Present

CMA Results, including Comparables, Sold, Current Listings, & Expired

8.

Offer

pricing strategy based on professional judgment and interpretation of current

market conditions

9.

Explain

market power and benefits of:

a.

Multiple

Listing Service

b.

Web

marketing

c.

IDX

and REALTOR.com

10.

Explain

agent's role in taking calls to screen for qualified buyers and protect seller

from curiosity seekers

11.

Review

and explain all clauses in Listing Contract & Addendum and obtain seller's

signature

Once Property is Under Listing Agreement

12.

Perform

exterior "Curb Appeal Assessment" of subject property

13.

Obtain

professional measurement of interior room sizes

14.

Confirm

lot size via owner's copy of certified survey, if available

15.

Note

any and all unrecorded property lines, agreements, easements

16.

Obtain

house plans, if applicable and available

17.

Hire

an Interior Design/Staging Assessment and review suggestions for changes to

shorten time on market

18.

Have

professional photos taken of home, amenities, and subdivision, for upload into

MLS and use in flyers.

19.

Prepare

showing instructions for buyers' agents

20.

Review

current appraisal if available

21.

Identify

Home Owner Association manager if applicable

22.

Verify

Home Owner Association Fees with manager - mandatory or optional and current

annual fee, transfer fees

23.

Order

copy of Homeowner Association bylaws, if applicable

24.

Obtain

average utility usage from last 12 months of bills

25.

Obtain

septic tank system permits, if applicable

26.

Well

Water: Confirm well status, depth and output from Well Report

27.

Verify

security system, current term of service and whether owned or leased

28.

Verify

if seller has transferable Termite Bond

29.

Ascertain

need for lead-based paint disclosure

30.

Prepare

detailed list of property amenities and assess market impact

31.

Prepare

detailed list of property's "Inclusions & Conveyances with Sale"

32.

Compile

list of completed repairs and maintenance items

33.

Obtain

extra key for lockbox, install yard sign

34.

Assist

seller with completion of Seller's Disclosure form

Entering

Property in Multiple Listing Service Database

35.

Enter

property data into MLS Listing Database

36.

Enter

property into List Hub to be distributed out into multiple other listing

services throughout the internet

Marketing

The Listing

37.

Create

print and Internet ads with seller's input

38.

Prepare

property marketing brochure

39.

Arrange

for printing or copying of supply of marketing brochures or fliers

40.

Mail

Out "Just Listed" notice to all neighborhood residents

41.

Provide

marketing data to buyers coming from referral network

42.

Coordinate

showings with owners, tenants, and other Realtors®.

43.

Return

all calls

44.

Accumulate

Feedback after showings

45.

Discuss

feedback from showing agents with seller to determine if changes will

accelerate the sale

46.

Review

comparable MLS listings regularly to ensure property remains competitive in

price, terms, conditions and availability

47.

Place

regular weekly update calls to seller to discuss marketing & pricing

The

Offer and Contract

48.

Receive

and review all Offer to Purchase contracts submitted by buyers or buyers'

agents

49.

Counsel

seller on offers. Explain merits and weakness of each component of each offer

50.

Contact

buyers' agents to review buyer's qualifications and discuss offer

51.

Prepare

and convey any counteroffers, acceptance or amendments to buyer's agent

52.

Obtain

pre-qualification letter on buyer from Loan Officer

53.

Provide

copies of contract and all addendums to closing attorney and/or title company

54.

Receive

and deposit buyer's earnest money in escrow account.

55.

Address

home/termite/septic inspection scheduling and resolution of associated issues

56.

Recommend

or assist seller with identifying and negotiating with trustworthy contractors

to perform any required repairs

Tracking

the Loan Process

57.

Contact

lender weekly to ensure processing is on track

58.

Relay

final approval of buyer's loan application to seller

The

Appraisal

59.

Provide

necessary information to Appraiser

60.

Follow-Up

On Appraisal

61.

Assist

seller in questioning appraisal report if it seems too low

Closing

Preparations and Duties

62.

Coordinate

closing process with buyer's agent and lender

63.

Ensure

all parties have all forms and information needed to close the sale

64.

Assist

in solving any title problems (boundary disputes, easements, etc) or in

obtaining Death Certificates

65.

Work

with buyer's agent in scheduling and conducting buyer's Final Walk-Thru prior

to closing

66.

Receive

& carefully review closing figures to ensure accuracy of preparation

Follow

Up After Closing

67. Respond

to any follow-on calls and provide any additional information required from

office files.

Monday, March 4, 2013

Buying a home can save you money

When can buying a home save you money?

There are two ways buying a home can save you money. First, if you are currently a renter and now

purchase a home, instead of paying money into the landlord, you will be ‘saving’

part of your monthly payment by investing in your home. The second way buying a home can save you

money is when the addition of mortgage interest paid, and real estate taxes paid

increase your itemized deductions on your annual tax returns such that they

exceed the standard allowed deduction.

Whoa – how do can you figure this out???

Let’s break it down. Per

the IRS, each year individuals have the option of deducting from taxable

income the greater of either the standard allowed deduction, or their itemized deductions. These two deductions, standard or itemized,

reduce the amount of income which is taxable by the federal government. So the greater the deduction, the less we pay

out in taxes.

For the 2012 tax filing year, the standard

deductions are: $11,900 for married

couples filing jointly, $5,950 for singles & married couples filing

separate, and $8,700 for heads of household. So if you are filing jointly as a married

couple you will deduct the standard deduction of $11,900 unless your itemized

deductions add up to greater than $11,900.

Itemized

deductions include things such as medical premiums, medical costs, sales

tax paid, charitable contributions, business expenses, AND, mortgage interest,

mortgage points, and real estate taxes. So

where you previously may have added up your itemized deductions and they weren’t

greater than the standard deduction, it is possible that with the addition of

mortgage interest and real estate taxes, you will have a greater deduction on

your tax return.

Let’s take an example.

On a $200,000 30-year mortgage @ 3.8%, one year of loan payments would total

around $11,183 (monthly payments of $931).

In the first year, $3,646 is paid to reduce the total loan amount. Payments to reduce the loan are considered invested

into the home as equity. The remaining,

$7,537 is paid out as interest. The

entire $7,537 is deductible as an itemized deduction. In addition, let’s say taxes paid on the

property are $1,500 for the year. The

entire $1,500 is deductible. So now in addition

to previous itemized deductions, you would have an additional $9,037 to add to

it. If you are a married couple filing

jointly, you will take the $11,900 standard deduction unless your itemized

deductions add up to greater than $11,900.

In this case, your itemized deductions are already at $9,037 without

adding on deductible business expenses and charitable donations, or other

allowed items. Can you see how you might

end up with itemized deductions greater than the standard? In fact, you could do some tax planning to

make sure it happens if you find that works to advantage.

Now we’ll discuss how renting versus owning can save you

money. Let’s look at it through an example. Using the loan information above we know a 30-year

$200,000 loan, at a rate of 3.8% has a monthly loan payment of $931. Let’s assume a couple is paying $1400 a month

in rent, plus $50 for trash pick-up and a parking space.

Now we’ll discuss how renting versus owning can save you

money. Let’s look at it through an example. Using the loan information above we know a 30-year

$200,000 loan, at a rate of 3.8% has a monthly loan payment of $931. Let’s assume a couple is paying $1400 a month

in rent, plus $50 for trash pick-up and a parking space.

They have saved up around $16,000 for a down payment and closing

costs on the purchase of a home. Under their

current budget of $1,450 monthly rent expense, with a loan payment of $931they

still have about $450 a month to cover other monthly home ownership expenses,

such as Real estate taxes, Homeowner’s insurance, potential Mortgage Insurance,

potential Homeowner’s Association dues, and other miscellaneous Home

Maintenance expenses.

So if they purchase a home, each month a portion of their

monthly $931 loan payment will reduce the loan principal and be ‘invested’ in

the home. When the couple eventually sells

the home, assuming they sell the home for more than the balance of their

mortgage, they will get back all of the money they have invested into the home

at the close of the sale. On the other

hand, if they continue to rent, all of the $1,400 monthly rent is paid out with

no return. Further, the purchase of a home

also allows them to deduct interest and real estate taxes paid on their tax

return as discussed above!

Buying a home can indeed save you money! Between the tax deductions and the investment

into your home, buying a home can indeed be the thing to do!

Still a little overwhelmed?

Don’t know how to apply this to your own situation? A REALTOR

® can help; this is part of their job. Contactme, I am more than happy to assist.

A REALTOR® will help you walk through this

information and connect you with a mortgage lender. The mortgage lender will calculate what types

of loans and loan amounts your situation indicates are appropriate. Then you can work with the REALTOR® to see what homes you can purchase at that price

point. Who knows, maybe you are in a

situation to start saving through buying!

Other resources:

Another resource discussing renting vs. buying at Realtor.com.

A rent vs. buy calculator at Realtor.com.

Kristen Richardson

is a Realtor with Keller Williams-Franklin.

TN lic#

325119

9175 Carothers Parkway, Ste 110, Franklin, TN 37067

o: 615-778-1818, c: 615-243-8073

Kristen@FromHereToClose.com

www.FromHereToClose.com

9175 Carothers Parkway, Ste 110, Franklin, TN 37067

o: 615-778-1818, c: 615-243-8073

Kristen@FromHereToClose.com

www.FromHereToClose.com

Friday, March 1, 2013

Purchasing Power

Not what the mortgage calculator tells you,

Maybe not even what your lender tells you …

Like many potential home buyers you may have found a mortgage calculator on the web. You eagerly entered in the estimated price of your dream home, the interest rate for which you have been told you may qualify (or you hope to qualify), and with the click of the mouse you get a magical number! Be wary! This is NOT all you need to consider before purchasing a home.

Like many potential home buyers you may have found a mortgage calculator on the web. You eagerly entered in the estimated price of your dream home, the interest rate for which you have been told you may qualify (or you hope to qualify), and with the click of the mouse you get a magical number! Be wary! This is NOT all you need to consider before purchasing a home.

MONTHLY EXPENSES

There is a 6th portion if your down payment is less than 20%. This sixth part is Private Mortgage Insurance or (PMI). Private Mortgage Insurance varies in cost based on what type of mortgage loan (conventional versus First Home Buyers versus Veterans Administration Loan, etc.), and what type of home purchased (single family home, townhouse, or condominium). Click here for information on PMI from the Federal Reserve Bureau. Click here for an article which walks you through the FHA PMI calculation. If you are putting less than 20% down, don’t forget to add PMI to your monthly expenses.

LOAN & INTEREST PAYMENT

+

+

PROPERTY TAXES AND HOME OWNERS INSURANCE

Property Taxes Property taxes are assessed on the land and building which you are purchasing. These taxes are to support the community services provided by those governments.

To determine property taxes for a potential home, check on your local real estate listing service. Property taxes are often noted as an annual expense. So make sure to clarify how the property tax is listed, if you see annual taxes = $1,200, you would divide this number by 12 to get the monthly expense.

Homeowner’s Insurance Home Owner’s Insurance is required by the mortgage company. This insurance is to protect your ability to pay your loan should certain damages occur to your property. Some properties will require additional insurance such as flood insurance.

Per the Federal Reserve Bureau, a general estimate of homeowner’s insurance may be calculated by dividing the purchase price of the house by $1,000, and then multiply the result by $3.50. Note, the Federal Reserve states the average home owner policy costs around $480 a year. You could use this average figure in place of calculating an estimate if you want to be more conservative. If additional insurance such as flood insurance is required, this cost would be in addition to the insurance cost calculated here.

Add up all four of the costs described above to get the total ‘mortgage’ payment (‘piti’). The total of these four costs provide you an estimate of the check you will be required to write out each month. Don’t forget to add in flood insurance or private mortgage insurance if you will be required to have those!

Add up all four of the costs described above to get the total ‘mortgage’ payment (‘piti’). The total of these four costs provide you an estimate of the check you will be required to write out each month. Don’t forget to add in flood insurance or private mortgage insurance if you will be required to have those!

HOME MAINTENANCE

There can be two parts to home maintenance expense: Home Owners Association Fees you may be required to pay, and the monthly costs you will incur to maintain your personal residence.

HOA Fees (home owner association fees) Monthly HOA fees for a single family home generally contribute to maintaining common areas within a development. Common areas include the green space, pool, club house, etc. Your Realtor can tell you if the property you desire has HOA fees.

Note for purchasers of Townhouses or Condominiums - The HOA fees for these homes MAY include Home Owners insurance in the HOA fee. If the HOA fee includes an insurance policy for the building and land, then the monthly home owner’s insurance payment as calculated above would not be relevant as it would be included here in the HOA fee instead.

The unit owner may or may not need to obtain a policy to cover the contents of the home (similar to a renter’s policy). Check the HOA Covenants and By Laws to determine if a policy such as this is required. You will want to add the cost for that policy to your monthly expense if you determine to purchase it.

Monthly Maintenance Costs To maintain your home you will incur expenses each year such as, lawn maintenance, sealing the driveway, irrigation, repair AC, fix dishwasher, fix leaky plumbing, etc. This cost can vary and you need to make your best estimate – is it an additional $100 a month or $500 a month?

This figure would be less if you own a town home where grounds and exterior maintenance are included in HOA fees. It would also be less if you purchase a home in a development where lawn maintenance is included in the HOA.

Not very handy with tools? Hiring help usually costs more than a good do-it-yourselfer (but less than a bad one!).

CLOSING COSTS

SO WHAT IS YOUR PURCHASING POWER?

Using the information provided about taxes and insurance above, calculate an estimate of the monthly property tax payment, and an estimate of the home owner insurance. Add these two costs to the monthly mortgage costs you just calculated for a starting point.

Finally, add on an estimate for monthly home maintenance costs. Is the result an amount you are willing to afford? Can you pay this amount, every month, comfortably?

Now you’ll have a good idea of YOUR purchasing power! From here you can adjust the price of your dream home up or down to get to YOUR monthly happy number!

Don’t forget to make sure you have the estimated 3% for cash toward closing in addition to your down payment!

Want some immediate help? Contact me - I assist my clients with worksheets which automate this process and help you as you move through your search!

Want some immediate help? Contact me - I assist my clients with worksheets which automate this process and help you as you move through your search!

Making sure you know a good estimate of these costs prior to your home search will help you and your REALTOR reduce the stresses of finding the right home!

Happy House Hunting!

A purchasing power calculator at Realtor.com.

Kristen Richardson, REALTOR® Keller Williams Realty-Franklin

TN lic# 325119

615-243-8073

FromHereToClose.com

Kristen is a former professional accountant. She is located in Middle Tennessee.

Maybe not even what your lender tells you …

Like many potential home buyers you may have found a mortgage calculator on the web. You eagerly entered in the estimated price of your dream home, the interest rate for which you have been told you may qualify (or you hope to qualify), and with the click of the mouse you get a magical number! Be wary! This is NOT all you need to consider before purchasing a home.

Like many potential home buyers you may have found a mortgage calculator on the web. You eagerly entered in the estimated price of your dream home, the interest rate for which you have been told you may qualify (or you hope to qualify), and with the click of the mouse you get a magical number! Be wary! This is NOT all you need to consider before purchasing a home.

There are more costs to home ownership than just that magic number. Your lender may even approve you for a lot larger monthly mortgage payment. Would you believe that once you add in all home ownership costs, you might not feel comfortable with either number? It can and does happen.

This page will cover five monthly home ownership costs. It will also briefly describe closing costs. You should know each of these costs PRIOR to determining what home price you feel you can comfortably afford.

DISCLAIMER **(This is not a substitute for obtaining professional advice and calculations from lenders. Costs and standards vary across regions of the country. This is only to be used as a tool to educate and provide a way for a potential buyer to understand and ESTIMATE for potential costs)**

MONTHLY EXPENSES

There are five basic monthly home ownership expenses: (1) principal loan payment, (2) loan interest payment, (3) monthly property tax payment, (4) monthly home owner’s insurance payment, and (5) monthly home maintenance expense.

There is a 6th portion if your down payment is less than 20%. This sixth part is Private Mortgage Insurance or (PMI). Private Mortgage Insurance varies in cost based on what type of mortgage loan (conventional versus First Home Buyers versus Veterans Administration Loan, etc.), and what type of home purchased (single family home, townhouse, or condominium). Click here for information on PMI from the Federal Reserve Bureau. Click here for an article which walks you through the FHA PMI calculation. If you are putting less than 20% down, don’t forget to add PMI to your monthly expenses.

LOAN & INTEREST PAYMENT

The mortgage principal or loan payment reduces your loan amount (principal refers to the total amount of money you borrow). The interest payment is the fee you pay to the bank in return for them lending you money. These two payments make up what is called the principal and interest (p&i) payment. This payment is usually the magic number you receive when you use mortgage calculators. These payments relate solely to the mortgage.

+

+

PROPERTY TAXES AND HOME OWNERS INSURANCE

Taxes and Insurance (t&i) costs make up part of the check you will write each month. The t&i portion of the payment is deposited into what banks call an escrow account (think of it as a depository). The t&i payments are accumulated in this account until the property taxes and home owner’s insurance is due, usually a one-time payment each year. The bank makes the payments on your behalf to the local and county governments and home owner’s insurance company.

Property Taxes Property taxes are assessed on the land and building which you are purchasing. These taxes are to support the community services provided by those governments.

To determine property taxes for a potential home, check on your local real estate listing service. Property taxes are often noted as an annual expense. So make sure to clarify how the property tax is listed, if you see annual taxes = $1,200, you would divide this number by 12 to get the monthly expense.

Homeowner’s Insurance Home Owner’s Insurance is required by the mortgage company. This insurance is to protect your ability to pay your loan should certain damages occur to your property. Some properties will require additional insurance such as flood insurance.

Per the Federal Reserve Bureau, a general estimate of homeowner’s insurance may be calculated by dividing the purchase price of the house by $1,000, and then multiply the result by $3.50. Note, the Federal Reserve states the average home owner policy costs around $480 a year. You could use this average figure in place of calculating an estimate if you want to be more conservative. If additional insurance such as flood insurance is required, this cost would be in addition to the insurance cost calculated here.

Add up all four of the costs described above to get the total ‘mortgage’ payment (‘piti’). The total of these four costs provide you an estimate of the check you will be required to write out each month. Don’t forget to add in flood insurance or private mortgage insurance if you will be required to have those!

Add up all four of the costs described above to get the total ‘mortgage’ payment (‘piti’). The total of these four costs provide you an estimate of the check you will be required to write out each month. Don’t forget to add in flood insurance or private mortgage insurance if you will be required to have those!

HOME MAINTENANCE

The fifth cost, home maintenance, is often overlooked by some home buyers. These are real costs, and, if you were a renter prior to home ownership, these will be entirely new and additional costs to you.

There can be two parts to home maintenance expense: Home Owners Association Fees you may be required to pay, and the monthly costs you will incur to maintain your personal residence.

HOA Fees (home owner association fees) Monthly HOA fees for a single family home generally contribute to maintaining common areas within a development. Common areas include the green space, pool, club house, etc. Your Realtor can tell you if the property you desire has HOA fees.

Note for purchasers of Townhouses or Condominiums - The HOA fees for these homes MAY include Home Owners insurance in the HOA fee. If the HOA fee includes an insurance policy for the building and land, then the monthly home owner’s insurance payment as calculated above would not be relevant as it would be included here in the HOA fee instead.

The unit owner may or may not need to obtain a policy to cover the contents of the home (similar to a renter’s policy). Check the HOA Covenants and By Laws to determine if a policy such as this is required. You will want to add the cost for that policy to your monthly expense if you determine to purchase it.

Monthly Maintenance Costs To maintain your home you will incur expenses each year such as, lawn maintenance, sealing the driveway, irrigation, repair AC, fix dishwasher, fix leaky plumbing, etc. This cost can vary and you need to make your best estimate – is it an additional $100 a month or $500 a month?

This figure would be less if you own a town home where grounds and exterior maintenance are included in HOA fees. It would also be less if you purchase a home in a development where lawn maintenance is included in the HOA.

Not very handy with tools? Hiring help usually costs more than a good do-it-yourselfer (but less than a bad one!).

CLOSING COSTS

Buyer closing costs in a real estate transaction are to pay for services from lenders for your loan, to attorneys to verify and legally complete contracts, to a loan originator to perform loan application processes, and many other services. Rather than enter into a detailed discussion, note that for most areas of the country, the Federal Reserve Bureau suggests estimating closing costs as 3% of purchase price. That 3% is the amount of cash the buyer needs to have on hand, in addition to the down payment. To reduce the amount of closing costs you must pay, you and your REALTOR can consider asking the seller to pay some of the costs as part of your negotiation.

SO WHAT IS YOUR PURCHASING POWER?

Start with how much money you have as a down payment and subtract that from the price of home you want to be able to afford. Plug the amount you would have to borrow into a mortgage calculator. Enter in the current average interest rateand see what the monthly principal and interest payment will be. Use this as your starting point.

Using the information provided about taxes and insurance above, calculate an estimate of the monthly property tax payment, and an estimate of the home owner insurance. Add these two costs to the monthly mortgage costs you just calculated for a starting point.

Finally, add on an estimate for monthly home maintenance costs. Is the result an amount you are willing to afford? Can you pay this amount, every month, comfortably?

Now you’ll have a good idea of YOUR purchasing power! From here you can adjust the price of your dream home up or down to get to YOUR monthly happy number!

Don’t forget to make sure you have the estimated 3% for cash toward closing in addition to your down payment!

Feeling a little shaky about all of this? Don't worry! This is why you work with a Professional REALTOR. If your REALTOR can’t or won’t help you walk through this information along with your lender, you may not have the right REALTOR.

Want some immediate help? Contact me - I assist my clients with worksheets which automate this process and help you as you move through your search!

Want some immediate help? Contact me - I assist my clients with worksheets which automate this process and help you as you move through your search!Making sure you know a good estimate of these costs prior to your home search will help you and your REALTOR reduce the stresses of finding the right home!

Happy House Hunting!

A purchasing power calculator at Realtor.com.

Kristen Richardson, REALTOR® Keller Williams Realty-Franklin

TN lic# 325119

615-243-8073

FromHereToClose.com

Kristen is a former professional accountant. She is located in Middle Tennessee.

Subscribe to:

Comments (Atom)